2024-11-15 Golden Agri-Resources HaiPress

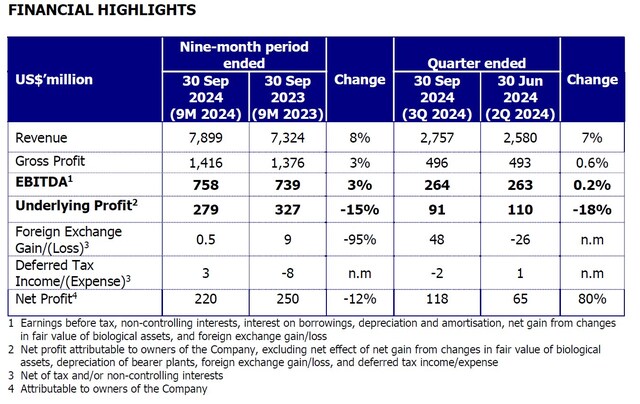

Nine-month 2024 revenue grew by 8% year-on-year while EBITDA increased to US$758 million with a margin of 9.6%

Downstream business growth mitigated the impact of lower production caused by El Niño conditions

Underlying profit impacted by increased financial expenses and income tax

SINGAPORE,Nov. 14,2024 -- Golden Agri-Resources Ltd ("GAR" or the "Company") recorded an 8% growth in revenue for the nine months ending September 2024,reaching almostUS$7.9 billion. Weaker plantation output caused by the ongoing effects of 2023's ElNiño conditions was mitigated by slightly higher crude palm oil (CPO) prices and expanded sales volumes during this period.

GAR's nine-month 2024 revenue grew by 8% year-on-year while EBITDA increased to US$758 million

EBITDA rose by 3%year-on-year to US$758 million,preserving a healthy margin of 9.6%. Meanwhile,underlying profit and net profit for the period decreased to US$279 million and US$220 million respectively. This was driven by increasedfinancial expenses,in line with a higher interest rate environment,and greaterincome tax expenses attributed to severalsubsidiaries operating in higher income tax countries.

GAR's financial position remainedstrong with a low gearing ratio of 0.61times and net debt to EBITDA of 0.53times.

On the outlook,Mr Franky O. Widjaja,GAR Chairman and Chief Executive Officer, commented: "The impact of the El Niño phenomenon in the second half of 2023 on Indonesia's palm oil output this year is worse than initially estimated by the industry. Sunflower oil and rapeseed oil production have also been disrupted by some crop losses due to unfavourable weather conditions. The recent increase in production of soybean oil has alleviated the tightness in global rapeseed and sunflower oil supply,although prices remain elevated. The market anticipates a seasonally low production period for palm oil inthe first half of next year,while Indonesia is planning for the implementation of an increased B40 biodieselblending mandate."

Mr. Widjaja added: "Unpredictable weather conditions in key producing countries and escalating geopolitical tensions remain critical factors likely to support vegetable oil prices. Nevertheless,the possibility of demand rationing,especially in price-sensitive markets,amidst the current high prices is an important factor to monitor."

OPERATIONAL HIGHLIGHTS

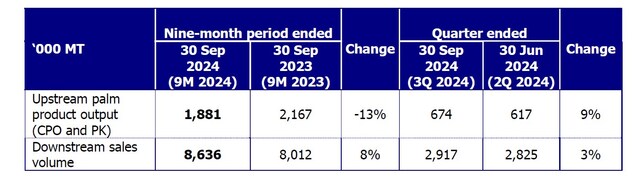

Downstream sales volume expanded by 8% during the period,demonstrating the efficacy of the GAR's integrated business model.

As of 30September2024,GAR's planted area was almost 534,000hectares,of which 486,000hectares were mature. Nucleus and plasma estates made up 417,000and 117,000hectares of this area respectively.

Fruit yield for the period decreased year-on-year from 14.4 tonnes per hectare in 2023 to 12.8 tonnes per hectare,as a result of land preparation for replanting and the impact of El Niño conditions in late 2023.While palm product output remains below last year's levels,it has recovered consistently each quarter and GAR expects the peak crop season to shift to the fourth quarter this year.

Elsewhere,sales volume in GAR's downstream business expanded by 8% during the nine months of 2024,demonstrating the efficacy of the Company's integrated business model and focus on pursuing higher value-added products.

ONGOING INVESTMENT IN SUSTAINABILITY

GAR can trace 100% of the palm produced on itsestates to plantation level. As of the third quarter of 2024,the company hasextended Traceability to the Plantation (TTP) to 99% of itstotal palm oil supply chain in Indonesia,including independent smallholder farmers. GARcontinuesto provide capacity building and training to ensure smallholders,who make up around 40% of the country's production,are not left out of traceable,sustainable supply chains.

The Company has built on this foundation to extend traceability to its global supply chains for palm and other commodities. GAR can now trace 100%of its soy,sugar,and coconut and 50% of sunflower oil supplies to mill level. This commitment to traceability across itssupply chains is fundamental to ensure GAR can meet growing customer and regulatory demands. The Company will continue to prioritise EU Deforestation-free Regulation (EUDR) readiness and is working closely with customers on compliance despite the potential delay to implementation.